Hi, I’m Peter Radizeski

Welcome to Onradsradar.com

Peter Radizeski is a seasoned consultant and analyst in the telecommunications industry. With years of experience, he provides valuable insights that help businesses make informed decisions.

Latest News

-

Tech Innovation Hub UAE: Driving Future-Ready Technology in Dubai

The United Arab Emirates has rapidly positioned itself as a global center for digital transformation, entrepreneurship, and advanced infrastructure. Today, the country is widely recognized as a leading tech innovation…

-

How Ads Management Improves Campaign Performance

Digital marketing has become a crucial component of modern business growth. With increasing competition across online platforms, companies must optimize their advertising strategies to reach the right audience. Running advertisements…

-

Cleaning and Maintenance Tips for KingKonree ADA Sinks

Maintaining cleanliness and functionality in accessible restrooms is essential for both hygiene and long-term durability. ADA sinks are designed to provide comfort and usability for individuals with mobility challenges, but…

-

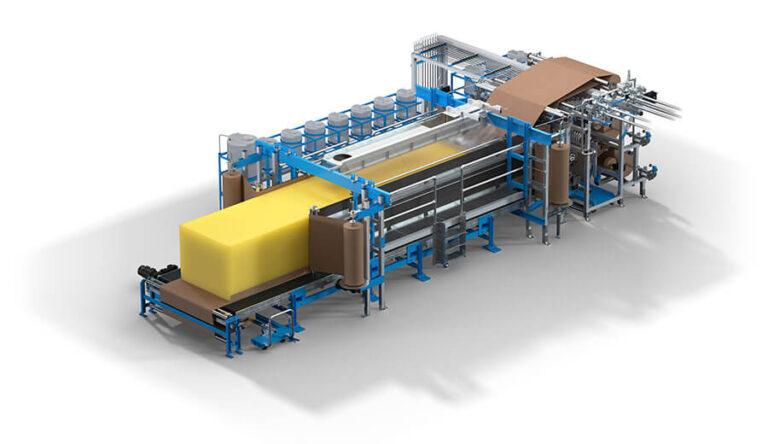

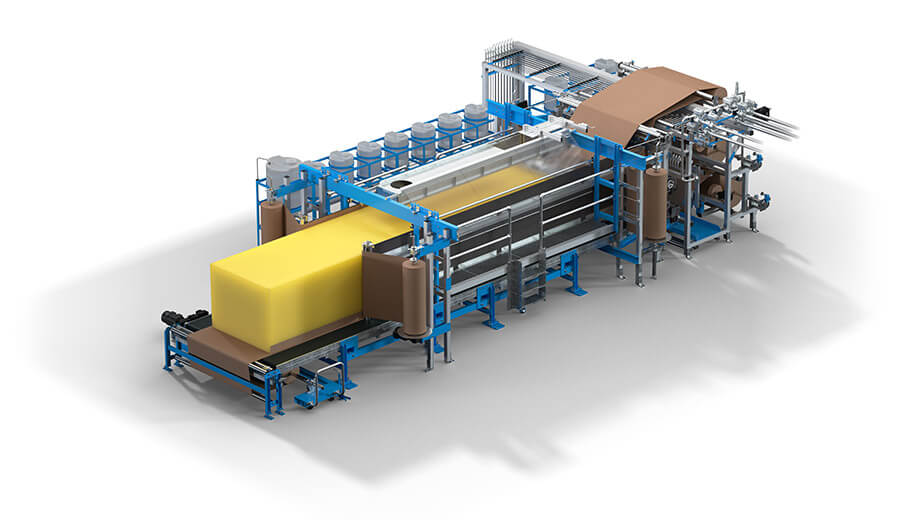

Overview of Polyurethane Foaming Machine Manufacturers and Their Capabilities

Polyurethane (PU) foam is an essential material used across industries such as automotive, furniture, construction, refrigeration, and packaging. The production of high-quality foam depends heavily on the performance and reliability…

-

AI Property Marketing Tools: The Complete Guide to Smarter Listings and Faster Sales

Buyers decide in seconds. They scroll past listings with poor photos, skip descriptions that blend together, and abandon properties that don’t match their unspoken preferences. Meanwhile, agents spend hours staging…

-

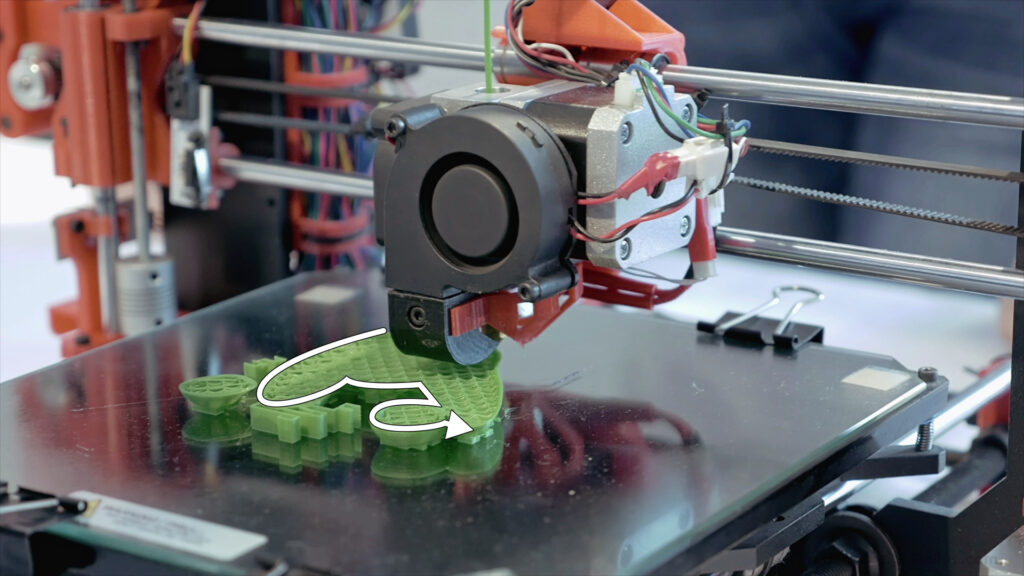

Trends in the Badge Wholesale Supply Industry

The badge wholesale supply industry has evolved significantly over the past decade, driven by changes in technology, consumer expectations, and organizational needs. Badges are no longer just simple identifiers or…

What You’ll Find Here

Industry Analysis: Stay informed with Peter’s take on the latest trends, mergers, and technological advancements shaping the telecom and MSP sectors.

Regulatory Insights: Understand the implications of policy changes and regulatory decisions on your business operations.

Market Dynamics: Gain a deeper understanding of market shifts, competitive landscapes, and growth opportunities.

Expert Commentary: Read thought-provoking opinions that challenge conventional wisdom and offer fresh perspectives.

Market Analysis

About Peter Radizeski

Peter Radizeski is the Founder and President of RAD-INFO INC., a telecommunications consulting firm. With over two decades of experience, Peter has established himself as a respected analyst, speaker, and consultant in the telecom sector.